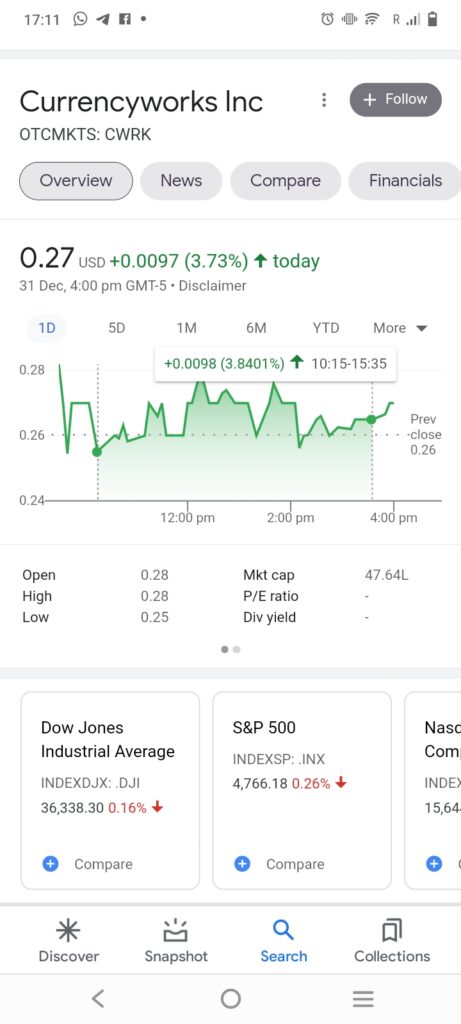

0.2700+0.0097 (+3.73%)

Cameron Chell about cwrk stock:

Well, welcome, everyone. Thanks so much, Erica. Thank you for your support. CurrencyWorks shareholders and other stakeholders. I truly appreciate everyone taking the time to listen to our Q3 2021 conference call. It’s with great satisfaction that I believe the entire team is in this position at the moment where we’re shifting slightly out of techdev mode , and a more and more into revenue and operational mode. As a result, we’ve had the opportunity to achieve an initial level in revenue during the period. therefore, it’s an all-time high for us however, we’re confident that we’ll grow from this point. So, we’ve got total revenue of $325,446,however, we’ll go into the details of this as we progress.

cwrk stock

Day’s Band 0.2528 + 0.2820

52 Week Band0.2020 3.7000 3.7000

Volume Volume 416,003

At closing: 03:59PM Eastern Time.

Prices for trade are not sourced from all markets

Next Close 0.2603

OPEN 0.2820

Avg. Volume364,175

Market Cap19.218M

Beta (5Y Monthly)3.64

PE Ratio (TTM)N/A

CurrencyWorks Announces the use of Strategic Financing in the amount of $500,000 by Management

Los Angeles, CA, December. 29th, 2021 (GLOBE NEWSWIRE) The company is CurrencyWorks Inc. (“CurrencyWorks” (also called as”the “Company”), (CSE CWRK CWRK, and OTCQB CWRK) a pioneer in the field of blockchain.

as well as a leading NFT or digital payments processor has announced on the 28th of December that today the Company plans to conclude a private placement that is unbrokered pursuant to the provisions of section 4(a)(2) (a)(2) (a)(2) of the Securities Act of 1933 or Regulation S under the Securities Act of 1933 and Regulation S under the Securities Act of 1933 as suitable.

In accordance to the provisions of which the Company will offer shares to executives and directors Jim Geiskopf, Cameron Chell and Swapan Kakumanu, the executive officers as well as directors of the Company or Regulation S under the Securities Act of 1933 in the event that it is applicable, shares of the common stock in exchange for gross proceeds of $50,000 to the Company.

They will then be offered at the prices at date the closing (OTCQB) at the time of closing (OTCQB) on 28th day of December 2021 with no discount and without warrants and are subject to the hold period under United States securities laws and in the event of a sale that is to the applicable Canadian laws on securities.

EP (TTM)-0.4780

Earnings Date: March 29th, 2022 – April 04 2022

Forward Dividend & YieldN/A (N/A)

Ex-Dividend DateN/A

1y Target EstN/A